The stock market has long been recognized as an avenue for wealth creation so we Simple Way to Make Money in Stock Market . It offers individuals the opportunity to grow their savings and investments over time. However, navigating the stock market can be overwhelming for newcomers. In this article, we will explore the key elements of wealth creation in the stock market, providing insights into understanding the market, conducting profound research, building a diversified portfolio, implementing a long-term investment strategy, and maximizing returns through risk management.

| 1. | Understanding the Stock Market |

| 2. | The Importance of Research |

| 3. | Building a Diversified Portfolio |

| 4. | Implementing a Long-Term Investment Strategy |

| 5. | Maximizing Returns through Risk Management |

Simple Way to Make Money in Stock Market

1. Understanding the Stock Market

Before embarking on your journey to wealth creation in the stock market, it is imperative to have a foundational understanding of how it functions. The stock market is a platform where individuals can buy and sell shares of publicly-traded companies. These shares represent ownership stakes in the companies, allowing investors to benefit from their growth and profitability.

The stock market operates through exchanges, such as the New York Stock Exchange (NYSE) and NASDAQ, where buyers and sellers come together to execute trades. Prices for stocks are determined dynamically based on the supply and demand for them.

It is essential to grasp the fundamental concepts, including stock exchanges, order types, market fluctuations, and the role of buyers and sellers, to make informed investment decisions.

Simple Way to Make Money in Stock Market

2. The Importance of Research

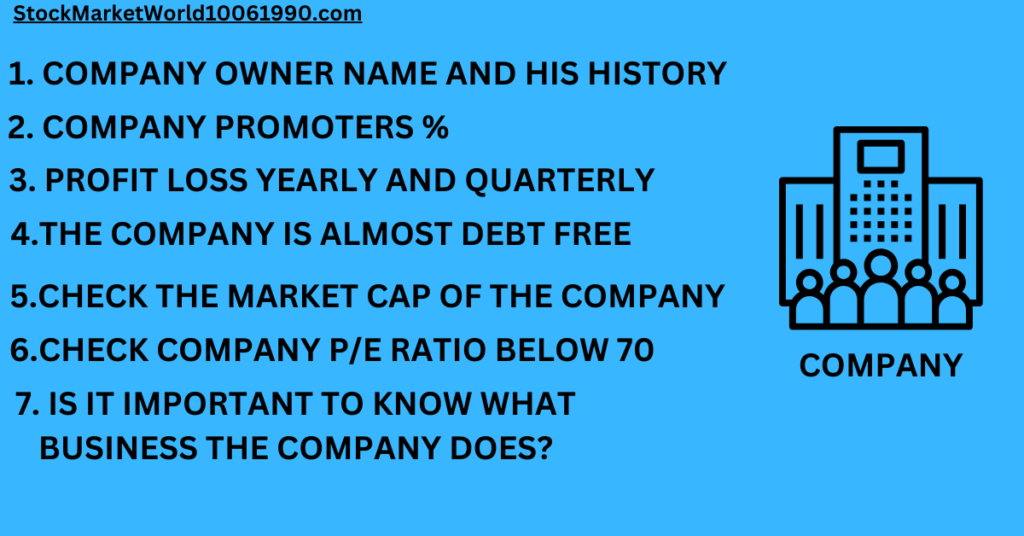

Research is the cornerstone of successful investing in the stock market. Conducting thorough research enables investors to identify potentially profitable investments while mitigating risks.

When researching stocks to invest in, it is crucial to examine the company’s financial health, including its earnings growth, revenue trends, and debt levels. Additionally, analysing industry trends, competitor analysis, and market conditions will provide valuable insights.

Investors should also pay attention to qualitative factors like the company’s management team, corporate governance, and overall industry outlook. In-depth research empowers investors to make informed decisions and mitigate potential pitfalls.

Simple Way to Make Money in Stock Market

3. Building a Diversified Portfolio

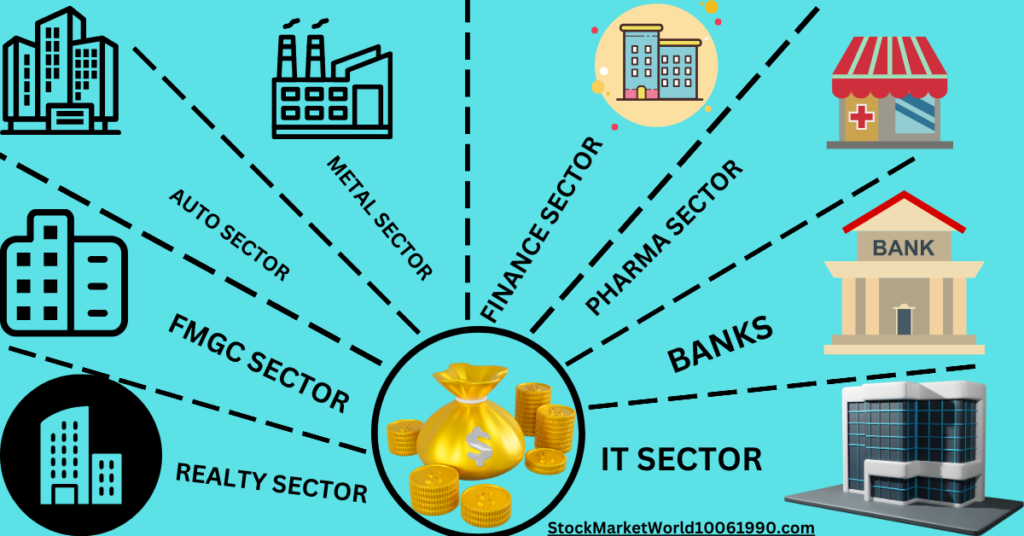

Building a diversified portfolio is a fundamental strategy for preserving and growing wealth in the stock market. Diversification involves spreading investments across different companies, industries, and asset classes to reduce risk and potential losses

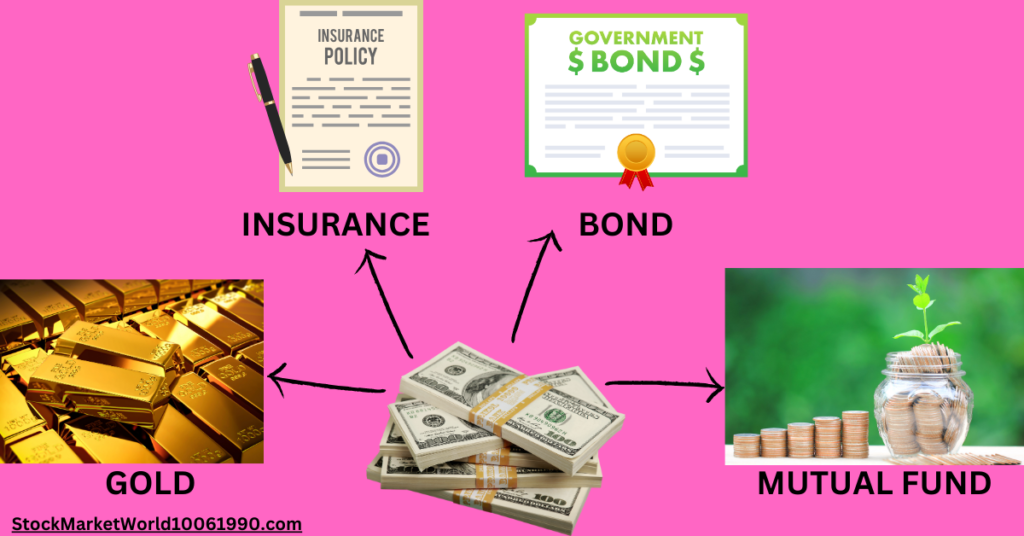

A well-diversified portfolio should combine a mix of stocks from different sectors, as well as bonds, exchange-traded funds (ETFs), and potentially other investment vehicles. This helps to minimize the impact of any one investment underperforming or experiencing volatility.

Structured diversification helps spread risk and smoothens returns over time, creating a balanced investment approach

Simple Way to Make Money in Stock Market

4. Implementing a Long-Term Investment Strategy

One key factor in wealth creation through the stock market is adopting a long-term investment strategy. Investing in the stock market requires patience and discipline, as it is a battle against short-term market volatility. By taking a long-term perspective, investors can ride out market fluctuations and benefit from the power of compounding.

A long-term investment strategy involves identifying high-quality companies with resilient business models and strong growth prospects. By investing in these companies, investors can capture their long-term value appreciation. Regularly reviewing and rebalancing the portfolio ensures it stays aligned with long-term goals.

Simple Way to Make Money in Stock Market

5. Maximizing Returns through Risk Management

Risk management is a vital component of wealth creation in the stock market. While higher returns often come with increased risk, it is crucial to strike a balance and manage risks effectively.

Diversification, as mentioned earlier, is one crucial risk management strategy. By spreading investments across different assets, investors can reduce exposure to any single investment’s risks.

Stay updated with market news, economic indicators, and industry trends. Staying informed helps investors make well-informed decisions based on changing market conditions.

Stop-loss orders can be employed to automatically sell a stock if it falls below a certain price, limiting potential losses. Establishing an emergency fund separate from investments can also help manage unexpected financial challenges.

In conclusion, wealth creation in the stock market requires a combination of understanding the market, conducting profound research, building a diversified portfolio, implementing a long-term investment strategy, and maximizing returns through risk management. While investing in the stock market involves risks, investing intelligently with a long-term perspective can yield substantial rewards. By continuously learning, adapting strategies, and staying disciplined, individuals can grow their wealth and achieve their financial goals in the stock market.

Remember, investing in the stock market should align with your risk tolerance and financial objectives. Before making any investment decisions, it is advised to consult with a financial advisor or professional.