Understanding the market’s dynamics and being able to spot upswing stocks can be beneficial skills for investors. 7 Key Strategies Free to Identify Uptrend in the Stock Market Investors might potentially profit on the growth potential of these equities by detecting the indicators of an uptrend. This post will look at seven essential tactics for identifying increasing stocks in the stock market.

1.Recognizing the Uptrend Phenomenon

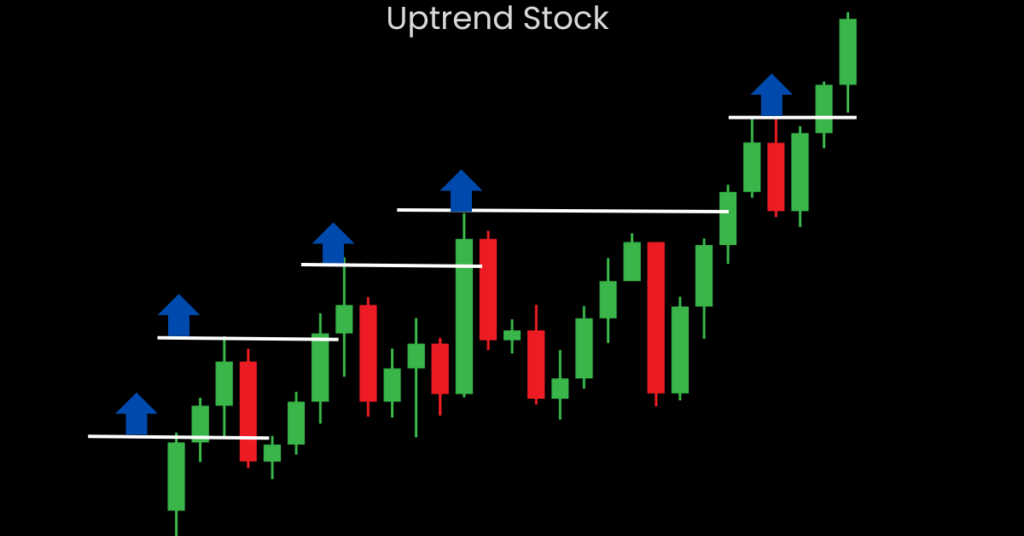

Before diving into the strategies for identifying uptrend stocks, it is important to understand what an uptrend actually means. An uptrend refers to a sustained increase in the price of a stock over time. It is characterized by higher highs and higher lows on a stock chart. Uptrends can be driven by a variety of factors such as strong earnings growth, positive market sentiment, robust industry trends, or any other positive factors influencing the stock’s performance.

Also Read:-NVidia Stock Price Prediction (NVDA FORCAST) 2024,2025,2030

2.Identifying Market Patterns for Up trending Stocks

One effective strategy for identifying uptrend stocks is by analysing market patterns. Technical analysis tools such as trendlines, moving averages, and chart patterns can provide valuable insights into the direction of stock prices. By examining these patterns, investors can spot potential uptrends and make informed investment decisions.

Major market indices, such as the S&P 500 or NASDAQ, can also serve as indicators of overall market conditions. When the market is in an uptrend, it increases the probability of individual stocks also experiencing an uptrend.

3.Identifying Long-Term Growth Potential

Investors looking for uptrend stocks should focus on identifying companies with strong long-term growth potential. Look for companies operating in industries with promising future prospects and those that have a track record of consistent revenue and earnings growth. Additionally, consider factors such as product innovation, market positioning, and competitive advantages that can drive future growth.

Researching and analysing the financial health of companies is crucial in assessing their long-term growth potential. Look for companies with strong balance sheets, solid cash flow, low debt levels, and positive free cash flow. These indicators can provide clues about a company’s ability to sustain an uptrend in the long term.

7 Key Plan Free to Identify Uptrend in the Stock Market

4.Examining Fundamental Indicators

Another strategy for identifying uptrend stocks is to examine fundamental indicators. Key fundamental indicators, such as earnings per share (EPS), price-to-earnings (P/E) ratio, and return on equity (ROE), can provide insights into a company’s financial performance. A consistent increase in these indicators over time can be a sign of an uptrend.

Additionally, consider the company’s revenue growth, profit margins, and market share. These factors can indicate the company’s ability to generate consistent growth and weather market downturns.

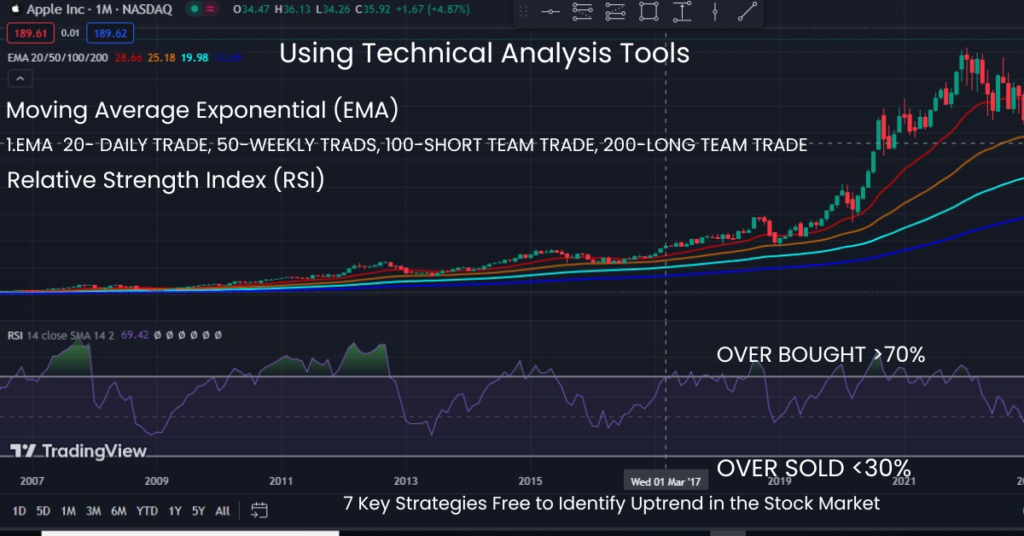

5.Using Technical Analysis Tools

Technical analysis is a widely used approach to identify uptrends in stocks. By analysing historical price and volume data, investors can identify patterns and trends that indicate potential uptrends. Here are a few commonly used technical analysis tools:

Moving Averages: Moving averages smooth out price fluctuations and help identify the overall direction of a stock trend. The 50-day and 200-day moving averages are commonly used to identify uptrends

Relative Strength Index (RSI): RSI measures the strength and speed of a stock’s price movement. An RSI above 70 indicates an overbought condition, while an RSI below 30 indicates an oversold condition. An RSI above 50 can suggest an uptrend.

Relative Strength Index (RSI): RSI measures the strength and speed of a stock’s price movement. An RSI above 70 indicates an overbought condition, while an RSI below 30 indicates an oversold condition. An RSI above 50 can suggest an uptrend.

MACD (Moving Average Convergence Divergence): MACD is a trend-following momentum indicator that shows the relationship between two moving averages. When the MACD line crosses above the signal line, it can signal the beginning of an uptrend.

6.Monitoring Insider Trading Activity

Monitoring insider trading activity can provide valuable insights into the prospects of a company. Insiders, such as executives and board members, have access to non-public information that can influence stock prices. If insiders are buying shares of their own company, it can be a strong indicator of future uptrends

Publicly available information on insider buying and selling can be easily accessed through the Securities and Exchange Commission’s (SEC) filings, such as Form 4. Keep an eye on significant insider buying activities, especially when multiple insiders are making purchases.

7.Staying Informed with Market News and Trends

Staying informed about market news and trends is crucial in identifying uptrend stocks. Regularly reading financial news, following industry-specific publications, and staying updated on market trends can provide valuable insights into potential uptrends.

Pay attention to earnings announcements, industry reports, and analyst recommendations. Positive news and market sentiment can often drive uptrends in stocks. Conversely, negative news or market conditions can reverse or halt an uptrend.

In conclusion, identifying uptrend stocks requires a combination of fundamental analysis, technical analysis, and staying up-to-date with market news and trends. By implementing the strategies discussed in this article, investors can increase their chances of identifying stocks with the potential for sustained growth and profitability. However, it is important to remember that investing in the stock market carries risks, and thorough research and due diligence are essential before making any investment decisions.